Taxes are incredibly complicated, so we could not have been capable of reply your question in the article. Get $30 off a tax session with a licensed CPA or EA, and we’ll be positive to offer you a sturdy, bespoke reply to whatever tax issues you could have. We don’t manage consumer funds or hold custody of belongings, we help customers connect with related financial advisors. Finance leaders are going through elevated expectations from each inside and exterior stakeholders.

Advertising For Construction Firms: 5 Of The Most Effective Strategies You Want To Know

Retained earnings are the profits your company made but didn’t give to shareholders as dividends. Suppose of it as money your small business earned and determined to maintain for future progress, paying off debt, or different enterprise needs. Scenario 1 – Bright Concepts Co. starts a model new accounting interval with $200,000 in retained earnings.

Agency Of The Long Run

If the company suffered a loss last year, then its beginning period RE will start with a adverse. An investor could make an thought via development evaluation whether the company is retaining its profit or its paying a part of earnings as dividends. Retained earnings seem under the shareholder’s fairness section on the legal responsibility aspect of the balance sheet, and sometimes corporations will show this as a separate line merchandise. If an organization declared a $1 cash dividend on all a hundred,000 outstanding shares, then the cash dividend declared by the company would be $100,000. When your business earns a surplus revenue you have two alternatives, you possibly can either distribute surplus revenue as dividends or reinvest the identical as retained earnings. It seems within the fairness part of your balance sheet and represents ownership value that belongs to shareholders.

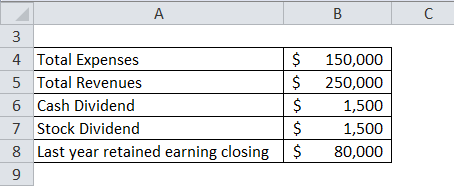

Therefore, a company can have positive retained earnings however not enough cash available to pay dividends. The assertion of retained earnings is a monetary assertion entirely devoted to calculating your retained earnings. Like the retained earnings method, the statement of retained earnings lists starting retained earnings, net earnings or loss, dividends paid, and the ultimate retained earnings. Dividends are sometimes paid in money to shareholders- to do that efficiently, the company first needs sufficient cash, as properly as excessive enough retained earnings. Different times, corporations may resolve to distribute further shares of their company’s inventory as dividends. This is named stock dividends, as they issue widespread shares to existing frequent stockholders.

- For instance, the first option results in the earnings money going out of the books and accounts of the business endlessly as a outcome of dividend payments are irreversible.

- General, Coca-Cola’s positive growth in retained earnings despite a sizeable distribution in dividends means that the company has a wholesome income-generating enterprise mannequin.

- In the same interval, the corporate issued $2.82 of dividends per share, whereas the entire earnings per share (diluted) was $18.32.

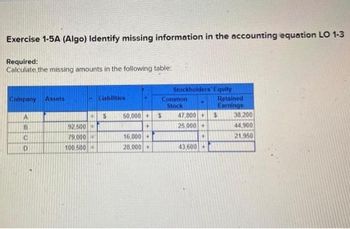

The figure is calculated at the finish of every accounting period (monthly, quarterly, or annually). As the method suggests, retained earnings are dependent on the corresponding determine of the previous time period. The resultant number may be either constructive or negative, relying on the net revenue or loss generated by the corporate over time. Alternatively, the corporate paying giant dividends that exceed the opposite figures can also lead to the retained earnings going negative. The expanded accounting equation provides a comprehensive framework for understanding how monetary actions impact a company’s total financial standing. By breaking down equity into its individual parts, it provides a clearer image of the methods revenue, expenses and distributions work together with belongings and liabilities.

A company might use part of its retained earnings to distribute dividends to shareholders. As per the equation, statement of retained earnings formulation rely upon the earlier yr figures. The prior period stability can be found on the opening balance sheet, whereas the online earnings is linked to the present interval revenue statement.

And whereas that looks as if a lot to have out there during your accounting cycles, it’s not. At least not when you have Wave that will assist you retained earnings equation button-up your books and generate necessary reviews. The revenue assertion is an important monetary doc that outlines the company’s revenues, expenses, and web loss or earnings over a specific period.

To arrive at retained earnings, the accountant will subtract all dividends, whether or not they are cash or inventory dividends, from the entire amount of profits and losses. Both retained earnings and reserves are important measures of a company’s monetary health. Retained earnings are the profits an organization has earned and retained over time, whereas reserves are funds put aside for specific functions, like contingencies or dividends. The starting retained earnings figure is required to calculate the present earnings for any given accounting period.

The company’s retained earnings stability is a key part of the shareholders’ equity. It is calculated as the whole earnings generated by the company, minus any dividends paid out to shareholders. The retained earnings account on the company’s balance sheet instantly pertains to its retained earnings, because it reveals the earnings the company has amassed over time. It is a crucial https://www.personal-accounting.org/ indicator of the company’s monetary performance and skill to reinvest profits into the enterprise for development and enlargement. A company would use retained earnings to reinvest its profits into the business for future growth and enlargement.

What Are The Disadvantages Of Calculating Retained Earnings?

Non-cash gadgets similar to write-downs or impairments and stock-based compensation also affect the account. Retained earnings serve as a financial cushion for the corporate, providing a source of funding when the enterprise faces financial downturns or needs to expand its operations. The significance of this quantity lies in the reality that it dictates how a lot cash a company can reinvest into its enterprise. For instance, in case you have a high-interest mortgage, paying that off might generate probably the most financial savings for your corporation.